Embarking on the journey to purchase a new car is an exciting venture, but it also demands thoughtful financial planning. For residents of Lake Wales, navigating this path can be seamless with the right budgeting strategy. This article aims to guide you through the essential steps of budgeting for a new car, ensuring that when you make that all-important purchase, it aligns perfectly with your financial landscape.

Assess Your Financial Situation

Before setting your sights on a new car, it’s crucial to take a holistic look at your finances. Analyze your income, monthly expenses, and existing debts. A clear understanding of your financial health will help you determine how much you can afford to spend on a car without overstretching your budget.

Determine Your Car-Buying Budget

The key to a wise car purchase in Lake Wales is to set a realistic budget. This budget should not only include the cost of the car itself but also factor in additional expenses such as taxes, registration fees, insurance, and potential future maintenance costs. As a rule of thumb, your car payment should not exceed 15-20% of your monthly take-home pay.

Plan for Down Payment and Financing

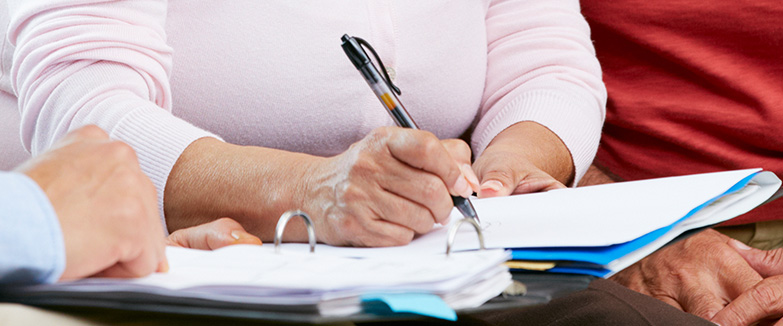

A substantial down payment can reduce your monthly installments and overall interest cost. Aim to put down at least 20% of the car’s price. When considering financing options, explore various lenders in Lake Wales, including banks, credit unions, and dealerships like Huston Cadillac. Compare interest rates and terms to find the best deal.

Tips for Preparing Personal Finances for a Loan or Lease

1. Assess Your Budget: Review your monthly income and expenses to determine how much you can realistically afford for car payments. Remember to include costs beyond the monthly payment, such as insurance, maintenance, and fuel.

2. Build a Savings Plan: Start setting aside funds for a down payment. A larger down payment can reduce your monthly payments and the total interest paid over the life of the loan.

3. Reduce Existing Debt: Lowering your current debt levels can improve your debt-to-income ratio, a key factor lenders consider. Try to pay down credit card balances, personal loans, or any other outstanding debts.

4. Create a Financial Buffer: Aim to have a cushion of savings to cover your car payments for a few months in case of unexpected financial challenges.

5. Understand the Total Costs: Be clear about all the costs involved in a car loan or lease, including interest rates, fees, taxes, and insurance. This understanding will help you plan more accurately.

Consider Total Ownership Costs

Beyond the purchase price, consider the total cost of owning a car. This includes fuel, insurance, maintenance, and repairs. Some vehicles may have higher insurance rates or maintenance costs, which can impact your long-term budget.

Explore Various Buying Options

In Lake Wales, you have several options when buying a new car. You can purchase outright, finance the car over a period, or opt for a lease. Each option has its pros and cons, and understanding these can help you make a decision that aligns with both your current and future financial situation.

Save for Your New Car

Once you have a budget in mind, start saving for your new car. Consider opening a dedicated savings account and contribute to it regularly. Cutting down on unnecessary expenses can accelerate your saving process.

Tips for Preparing Your Credit Score

1. Check Your Credit Report: Obtain a copy of your credit report from major credit bureaus to understand your credit standing. Review it for any errors or discrepancies that might affect your score.

2. Pay Bills on Time: Your payment history is a significant component of your credit score. Ensure all your bills, especially credit cards and loans, are paid on time.

3. Reduce Credit Card Utilization: High credit card balances can negatively impact your credit score. Aim to keep your credit utilization ratio below 30% of your available credit.

4. Avoid New Credit Applications: Each credit application can cause a small dip in your credit score. Avoid applying for new credit cards or loans in the months leading up to your car loan or lease application.

5. Address Outstanding Collections: If you have any collections or past due accounts, try to settle them. These can be red flags for lenders and negatively impact your credit score.

6. Length of Credit History: The longer your history of managing credit responsibly, the better it is for your score. Keep older accounts open, even if you don’t use them frequently.

Take Advantage of Special Offers

Keep an eye out for special offers and promotions. Dealerships like Huston Cadillac often have deals that can provide significant savings or favorable financing terms.

Test Drive and Negotiate

When you’re ready to buy, take the time to test drive different models to find the perfect fit for your needs. Don’t hesitate to negotiate the price and terms; a little haggling can sometimes lead to substantial savings.

Discover Your Dream Car at Huston Cadillac in Lake Wales

In the heart of Lake Wales, where the beauty of Florida’s landscapes meets the vibrant community spirit, Huston Cadillac stands ready to elevate your driving experience. As you consider upgrading your vehicle, we invite you to explore our New Inventory, where the latest models await, or delve into our Pre-owned Inventory for quality and value. At Huston Cadillac, we understand the excitement that comes with finding the perfect vehicle, and our dedicated team is here to guide you every step of the way. Experience the convenience of our Buy at Home service or visit us in person to immerse yourself in the luxury that only a Cadillac can offer. Don’t miss our Special Offers, designed to make your dream car a reality. Schedule a test drive today and embark on your journey to automotive excellence with Huston Cadillac.

Closing Thoughts: Your New Car Awaits

Budgeting for a new car is a critical step towards a financially savvy purchase. By assessing your finances, setting a realistic budget, considering total ownership costs, and exploring various buying options, you can ensure a wise investment. For Lake Wales residents, the journey to owning a new car can be as thrilling as it is fiscally responsible.